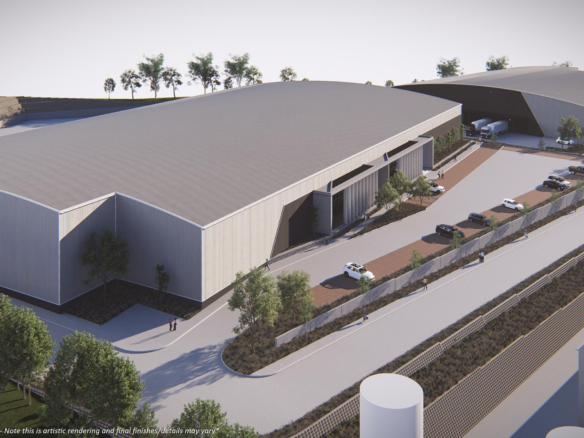

Investment Case for Redeveloping 16 Brass Street, Brackenfell into a Small Industrial Park

Property Overview: The 9,932m² freestanding industrial property at 16 Brass Street, Brackenfell, presents a compelling opportunity for redevelopment into a modern small industrial park. Strategically located in Cape Town’s thriving Northern Suburbs, this asset is well-positioned to capitalize on strong demand for industrial space, favorable market dynamics, and cost-effective redevelopment potential. With its large footprint, recent upgrades, and prime connectivity, redeveloping this property into a multi-tenant industrial park offers attractive risk-adjusted returns for investors seeking high-yield CRE investments in Brackenfell.

Market Demand for Small Industrial Parks in Brackenfell

Brackenfell, located adjacent to Bellville in Cape Town’s Northern Suburbs, has emerged as a key industrial hub, driven by its strategic location and robust infrastructure. The demand for small industrial parks—comprising flexible, smaller units (150-1,500m²)—is particularly strong due to the following factors:

Read More

-

Low Vacancy Rates and Rental Growth:

-

Cape Town’s industrial property sector demonstrates remarkable resilience, with low vacancy rates (estimated at 2-4% in Brackenfell) and consistent rental growth. Industrial rentals in Brackenfell range from R65-R85/m² for standard warehouses to R100-R120/m² for modern, A-grade facilities, reflecting strong tenant demand.

-

Small industrial units are highly sought after by SMEs, logistics firms, and light manufacturing businesses, which value affordability and flexibility. The 9,932m² site can be subdivided into 10-15 units (e.g., 500-1,000m² each), catering to this high-demand segment.

-

Strategic Location and Connectivity:

-

Situated near Old Paarl Road, Okavango Road, and the N1 and R300 highways, 16 Brass Street offers unparalleled access to Cape Town’s logistics network, including Cape Town International Airport (20km away) and major ports. This connectivity is critical for tenants in warehousing, distribution, and e-commerce.

-

Proximity to industrial nodes like Okavango Park, Everite Business Park, and Brackengate Business Park enhances the property’s appeal, as these areas host national companies and distribution centers, fostering a vibrant business ecosystem.

-

Economic and Demographic Drivers:

-

The Northern Suburbs are among the fastest-growing areas in the Western Cape, driven by residential expansion and industrial development. Brackenfell’s proximity to densely populated areas ensures a steady labor pool and consumer base, ideal for tenant operations.

-

The rise of e-commerce and last-mile logistics has increased demand for smaller, well-located industrial spaces, particularly in secure parks with modern amenities, aligning perfectly with the proposed redevelopment.

-

Public Transport and Accessibility:

-

The property’s access to Metrorail (Brackenfell station) and minibus taxi services supports tenant workforce mobility, reducing operational costs and enhancing tenant retention.

Redevelopment Plan: Small Industrial Park

The proposed redevelopment transforms the 9,932m² property into a modern small industrial park with 10-15 flexible units, each ranging from 500-1,000m². Key features include:

-

Unit Configuration: Subdivide the existing structure into smaller warehouses with individual roller shutter doors, office components, and exclusive yard areas. Retain the two wide access doors for shared logistics efficiency.

-

Upgrades: Enhance the existing roof upgrades with solar panels for energy efficiency, install fibre connectivity, and add sprinkler systems and high-power supply (e.g., 60-100 Amps per unit) to meet A-grade standards.

-

Amenities: Maintain the reception area, bathrooms, and parking (expand to 50-60 bays at R1,150/month each, excluding VAT), and introduce 24-hour security, CCTV, and electric fencing to align with tenant expectations in Brackengate Business Park.

-

Yard Space: Utilize the large footprint to provide dedicated yard areas (e.g., 100-200m² per unit) for tenant storage or vehicle access, a premium feature in Brackenfell.

Prevailing Costs and Financial Feasibility

Redevelopment Costs

-

Construction Costs: Building costs in the Western Cape for industrial properties average R14,500/m² for new builds, but redevelopment (retrofitting the existing structure) is significantly lower, estimated at R8,000-R10,000/m² due to the property’s good condition and recent roof upgrades.

-

Total redevelopment cost: 9,932m² x R9,000/m² = R89.39 million (including upgrades like solar, security, and subdivision).

-

Tenant Installation (TI) Allowance: Provide a standard TI allowance (e.g., R500/m² for a 3-year lease) to attract tenants, costing approximately R4.97 million (9,932m² x R500).

-

Contingency and Professional Fees: Allocate 10% for contingencies and 5% for architects/engineers, adding R13.41 million.

-

Total Project Cost: R107.77 million (excluding land acquisition, assuming the investor owns the property or acquires it separately).

Revenue Projections

-

Rental Income: Assuming 90% lettable area (8,939m² after common areas), at R100/m² (A-grade rate), annual gross rental income is R10.73 million (8,939m² x R100/m² x 12 months).

-

Parking Income: 50 parking bays at R1,150/month (excluding VAT) generate R690,000 annually (50 x R1,150 x 12).

-

Total Gross Income: R11.42 million/year.

-

Operating Expenses: Estimated at 10% of gross income (R1.14 million), including rates, maintenance, and security.

-

Net Operating Income (NOI): R10.28 million/year.

-

Escalation: Apply a 7% annual rental escalation, aligning with Brackenfell market norms, to grow NOI over time.

Investment Metrics

-

Capitalization Rate (Cap Rate): Using a conservative 9.5% cap rate (typical for industrial parks in Cape Town), the stabilized value post-redevelopment is R108.21 million (R10.28 million NOI ÷ 0.095).

-

Net Initial Yield: Assuming a total project cost of R107.77 million, the initial yield is 9.54% (R10.28 million ÷ R107.77 million), highly competitive for industrial CRE investments in Cape Town.

-

Internal Rate of Return (IRR): Over a 5-year hold, with 7% rental escalations and a 5% terminal cap rate, the IRR is estimated at 12-14%, driven by strong rental growth and low vacancy risk.

-

Payback Period: The project recovers costs in approximately 10.5 years (R107.77 million ÷ R10.28 million), with potential for faster recovery if sold at stabilization.

Risks and Mitigations

-

Construction Risk:

-

Risk: Delays or cost overruns in redevelopment.

-

Mitigation: Engage experienced contractors with a track record in Brackenfell (e.g., firms active in Brackengate). Use fixed-price contracts and include a 10% contingency budget.

-

Tenant Risk:

-

Market Risk:

-

Risk: Economic downturn affecting industrial demand.

-

Mitigation: Brackenfell’s low vacancy rates and e-commerce growth provide a buffer. Diversify tenant mix (e.g., logistics, manufacturing, retail storage) to spread risk.

Marketing Strategy for Redevelopment

To maximize tenant interest and investor appeal, Cape Town Property Group can deploy its robust marketing channels:

-

Property Portals: List units on Property24 and Private Property with SEO-optimized descriptions (e.g., “small industrial units for rent in Brackenfell”).

-

Newsletter: Feature the park in a subscriber newsletter, targeting logistics and SME tenants.

-

Social Media: Promote via LinkedIn and Instagram with drone footage and virtual tours, highlighting connectivity and modern amenities.

-

Targeted Campaigns: Use data-driven email campaigns to reach investors and tenants in your buyer network, emphasizing the 9.54% yield and strategic location.

Conclusion

Redeveloping 16 Brass Street into a small industrial park is a high-potential investment, driven by Brackenfell’s strong industrial demand, low vacancies, and the property’s prime 9,932m² footprint. With a projected 9.54% initial yield, 12-14% IRR, and a stabilized value of R108.21 million, the project offers attractive returns for investors seeking industrial real estate opportunities in Cape Town. The property’s connectivity, recent upgrades, and alignment with SME needs make it an ideal candidate for a modern, multi-tenant park. Cape Town Property Group’s expertise, networks, and marketing channels ensure successful execution and tenant uptake. For further analysis or to explore financing options, contact our team to discuss next steps.

Disclaimer

The information provided in the investment case for the redevelopment of 16 Brass Street, Brackenfell, into a small industrial park is for informational purposes only and does not constitute financial, legal, or investment advice. The analysis is based on general market knowledge, provided property details, and assumptions about prevailing costs, market demand, and CRE metrics in Brackenfell, Cape Town, as of April 17, 2025. Actual costs, rental rates, vacancy rates, yields, and investment returns may vary due to market fluctuations, economic conditions, or unforeseen circumstances.

Cape Town Property Group and the author assume no responsibility for any decisions made based on this information. Investors are strongly advised to conduct independent due diligence, consult with qualified financial advisors, legal counsel, and real estate professionals, and verify all data before proceeding with any investment or redevelopment project. Redevelopment involves risks, including construction delays, cost overruns, tenant leasing challenges, and market volatility, which may impact projected outcomes.

Any references to third-party platforms, market data, or industry trends are sourced from publicly available information or general knowledge and are not guaranteed for accuracy or completeness. The use of Cape Town Property Group’s marketing channels, peer network, or buyer network is illustrative and subject to operational constraints.

For specific inquiries or tailored advice regarding the 16 Brass Street property or other commercial real estate opportunities, please contact Cape Town Property Group directly.

Hashtags: #CREDisclaimer #BrackenfellInvestment #CapeTownPropertyGroup #IndustrialRealEstate #InvestmentRisk #SouthAfricaCRE